The headlines tell a troubling story: Common Living raised $110 million, then filed Chapter 7 bankruptcy in 2024. Quarters collapsed in 2021. The Collective shuttered in 2022. For observers, coliving appears to be imploding.

However, a closer look at the data reveals a different narrative. While high-profile operators burned through venture capital, the global coliving market grew from $7.82 billion in 2024 to a projected $16.05 billion by 2030, a 13.5% compound annual growth rate. In the UK alone, planning applications surged 87% in 2024.

The industry isn’t dying. It’s undergoing natural selection. And the survivors are teaching us what works.

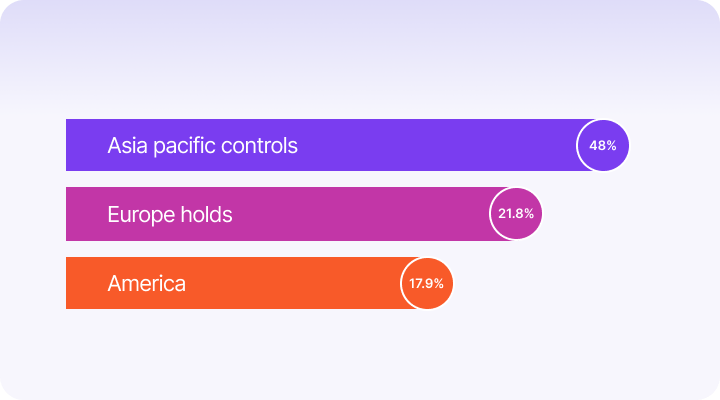

Asia Pacific controls 48% of the global coliving market. Europe holds 21.8%. North America, despite its enthusiasm for venture capital, accounts for only 17.9%.

This distribution isn’t random. It reflects fundamental differences in housing affordability, cultural acceptance of shared living, regulatory environments, and urban density. The regions where coliving dominates are those where it solves genuine housing crises, not lifestyle preferences.

North American operators who treated coliving as a “cool amenity” for young professionals struggled. Those who positioned it as affordable housing infrastructure in expensive gateway cities survived.

Coliving works where housing economics are broken, not where they’re merely inconvenient.

The average coliving resident is 28 years old, with nearly half coming from overseas. This demographic clarity is both coliving’s strength and its limitation.

Young international professionals, students, and digital nomads value flexibility, community, and turnkey living. They’ll pay premium rents for it. But this segment represents a finite market in any given city. Operators who assumed they could expand this demographic upward or outward discovered the hard truth: families don’t want shared kitchens, established professionals prefer privacy, and older demographics value ownership.

The operators who survived understood this from the start. They designed for a specific persona, calculated the addressable market in their target geography, and built accordingly. They didn’t try to be everything to everyone.

Coliving is a niche play, not a mass market revolution. Own the niche.

The coliving industry today looks like every maturing sector: consolidation, professionalization, and a widening gap between disciplined operators and hopeful amateurs.

The path forward is clear for those willing to see it:

Geographic concentration beats geographic expansion. Operational density creates competitive moats.

Target cities where rent-to-income ratios exceed 40%, where international talent flows, and where traditional housing supply lags demand.

Beautiful spaces without operational excellence create beautiful failures. Technology infrastructure, management training, and service delivery separate sustainable businesses from real estate experiments.

Coliving works for specific demographics in specific markets with specific operational capabilities. Pretending otherwise leads to the graveyard where Common, Quarters, and The Collective now reside.

Coliving is a niche play, not a mass market revolution. Own the niche.

For decades, real estate has been understood through familiar fundamentals: location, supply, and demand. These pillars continue to matter, but they no longer tell the full story. A quieter yet more powerful force is reshaping the industry the way people choose to live.

Urban life today is defined by movement. People relocate more frequently for education, careers, and opportunity. Work has untethered itself from fixed offices. Home ownership, once considered a milestone of stability, is being delayed or reconsidered altogether. In this evolving reality, traditional rental models built around long-term leases, rigid commitments, and self-managed living are beginning to feel out of step with modern expectations.

It is within this context that Coliving emerges, not as an alternative housing format, but as a strategic response to change.

Coliving is often described as shared housing, but this definition barely scratches the surface. At its core, Coliving reflects a deeper transformation from real estate as a static asset to real estate as a living experience.

For many tenants today, permanence is no longer the primary goal. What matters instead is ease of entry, freedom of movement, and the ability to belong without long-term obligation. Coliving responds to this reality by offering flexibility, managed services, and community-driven environments, elements that traditional rentals struggle to deliver at scale.

This shift signals an important evolution: residential real estate is no longer only about providing shelter; it is about enabling lifestyles.

Housing decisions are increasingly influenced by how well a space fits into daily life. Rent and size still matter, but they are no longer the sole drivers.

Modern tenants value:

Among students, young professionals, and mobile workforces, Coliving has moved beyond being a temporary solution. It has become a preferred way of living, one that aligns with both professional mobility and personal comfort.

Agentic AI can deliver big wins by 2030, but only if you balance bold ideas with careful planning. Start with a focused pilot, build the right platform, layer in oversight, and invest in your team. Do that, and you’ll turn early experiments into reliable, autonomous tools.