Financial services are no longer experimenting with Generative AI. By 2026, it has become a core capability shaping how banks, fintech startups, insurers, and payment platforms design products, manage risk, and interact with customers. What makes Generative AI in fintech different from earlier automation waves is not speed or scale alone. It is the ability to reason, generate, contextualize, and adapt across complex financial workflows that were traditionally human dependent.

This guide explains how AI in fintech actually works, where it delivers real value, how modern architectures are built, and what impact it is having on the industry in 2026, beyond the surface level hype.

A 36-page report highlighting the state of generative AI models including technology overview. Generative AI refers to models that can create new outputs such as text, code, simulations, recommendations, or decisions based on learned patterns. In fintech, this capability goes far beyond chatbots.

Unlike traditional rule based or predictive AI, generative AI systems can:

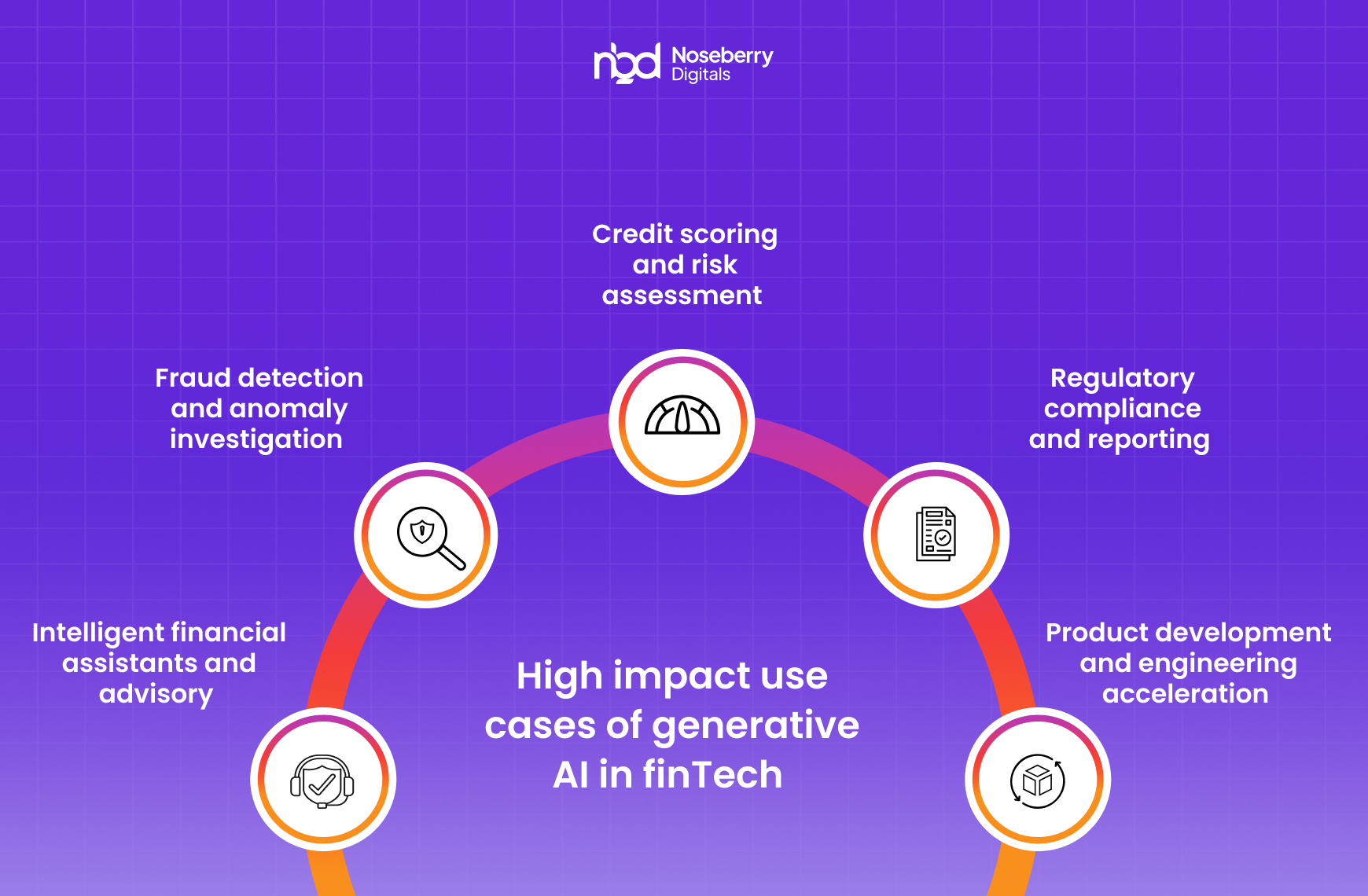

This makes AI in fintech suitable for high stakes domains such as compliance, fraud detection, credit decisioning, financial advisory, and operational intelligence.

Three forces have converged to make generative AI central to fintech today.

First, financial institutions now sit on massive volumes of structured and unstructured data including transactions, contracts, customer interactions, and regulatory documents. Generative models are uniquely capable of extracting meaning across these datasets.

Second, customer expectations have shifted. Users expect real time, personalized, conversational financial experiences that traditional systems cannot deliver efficiently.

Third, the regulatory complexity has increased. Institutions need systems that can interpret, explain, and adapt to evolving rules rather than hard coded compliance logic.

Generative AI addresses all three by acting as a cognitive layer across financial systems.

Generative AI enables financial assistants that understand user context, financial history, goals, and constraints. Unlike scripted bots, these systems can:

The key shift is from reactive support to proactive financial guidance.

Traditional fraud systems rely on predefined rules or anomaly thresholds. Generative AI adds a reasoning layer by:

This reduces false positives while improving investigation speed and accuracy.

Generative AI in fintech is increasingly used to augment credit decisions by:

This improves inclusion while maintaining regulatory defensibility.

Compliance is one of the most impactful areas for generative AI adoption. Models can:

The value lies not just in automation, but in interpretability and traceability.

Fintech teams use generative AI to:

This shortens product cycles while improving reliability.

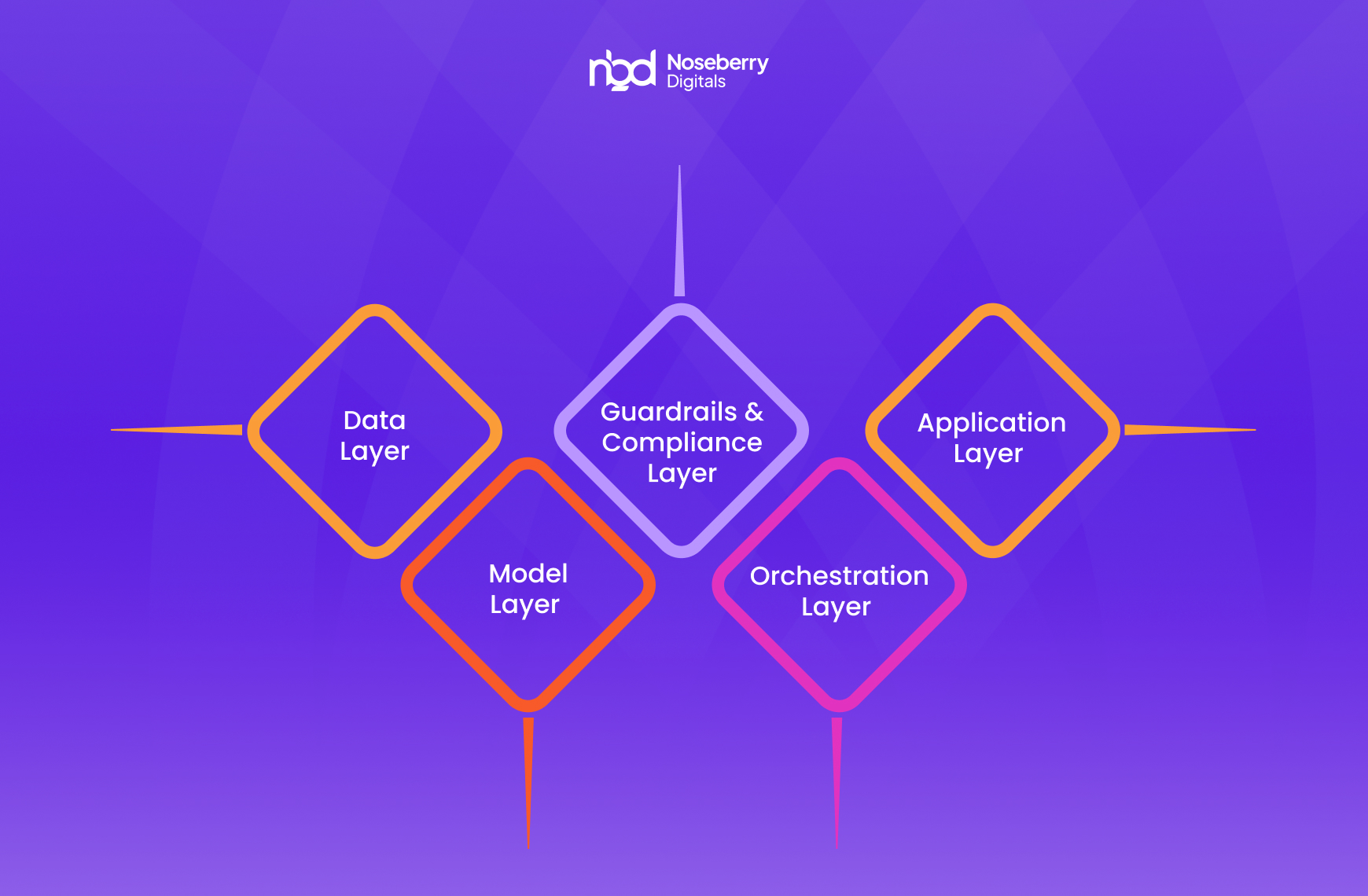

A common mistake is treating generative AI as a standalone tool. In mature fintech environments, it is embedded within a layered architecture.

This includes transaction data, customer profiles, logs, documents, and third-party data sources. Strong data governance and lineage tracking are essential.

Typically combines:

This layer manages prompts, workflows, validation rules, and escalation paths. It ensures AI outputs are aligned with business and regulatory requirements.

Includes:

Where AI capabilities surface as features such as advisors, dashboards, alerts, or automation tools.

This architecture ensures generative AI enhances systems rather than operating as an uncontrolled black box.

In regulated finance, fully autonomous AI decisions are rare. The real value comes from AI that supports human judgment by generating context, scenarios, and explanations.

In 2026, prompts are treated as controlled artifacts similar to business rules. Poor prompt design can introduce compliance or risk issues just as easily as faulty code.

Larger models do not automatically create better fintech outcomes. Systems that integrate proprietary data, feedback loops, and domain constraints outperform generic implementations.

Institutions that can clearly explain AI-driven decisions to regulators and customers build trust faster and scale adoption more safely.

Generative AI in fintech also introduces real risks:

Successful organizations address these through governance, monitoring, and human oversight rather than attempting full automation.

By 2026, generative AI in fintech is no longer about novelty. It is about cognitive leverages. Institutions that treat it as a strategic capability, supported by strong data foundations and governance, gain faster decision cycles, better customer experiences, and more resilient compliance operations.

The winners will not be those who deploy the biggest models, but those who integrate intelligence responsibly into the core of their financial systems.

FAQ

Traditional AI focuses on prediction and classification based on fixed patterns. Generative AI can create new outputs, reason across unstructured data, and adapt responses dynamically. This makes it suitable for advisory, compliance, and complex decision support.

It can be safe when implemented with strong guardrails, explainability, audit logs, and human oversight. Most successful deployments use AI as a support layer rather than an autonomous decision engine.

High quality transaction data, customer interaction data, regulatory documents, and operational logs are commonly used. Proprietary data combined with domain fine tuning delivers the most value.

No. In practice, it augments human roles by handling analysis, summarization, and scenario generation. Humans remain responsible for final decisions, accountability, and judgment.

It helps interpret regulations, map them to controls, generate reports, and surface potential gaps early. This reduces manual effort while improving consistency and traceability.